The 6-Minute Rule for Eb5 Investment Immigration

Citizenship, with investment. Presently, as of March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Locations and Country Locations) and $1,050,000 elsewhere (non-TEA zones). Congress has actually approved these amounts for the following five years starting March 15, 2022.

To receive the EB-5 Visa, Investors should create 10 full-time united state work within 2 years from the date of their complete investment. EB5 Investment Immigration. This EB-5 Visa Requirement makes certain that investments contribute directly to the united state job market. This applies whether the tasks are developed straight by the business or indirectly under sponsorship of a marked EB-5 Regional Facility like EB5 United

Eb5 Investment Immigration Can Be Fun For Everyone

These tasks are determined with designs that use inputs such as development costs (e.g., construction and devices expenditures) or yearly earnings created by continuous operations. In comparison, under the standalone, or straight, EB-5 Program, just direct, full-time W-2 employee placements within the business business may be counted. A key risk of relying solely on straight workers is that personnel reductions as a result of market problems could cause insufficient permanent settings, potentially causing USCIS denial of the capitalist's request if the job development need is not satisfied.

The economic model after that forecasts the number of straight jobs the brand-new business is most likely to create based on its expected incomes. Indirect work determined via economic designs describes work produced in industries that provide the products or solutions to business directly included in the task. These jobs are developed as a result of the raised demand for items, products, or solutions that support business's operations.

See This Report on Eb5 Investment Immigration

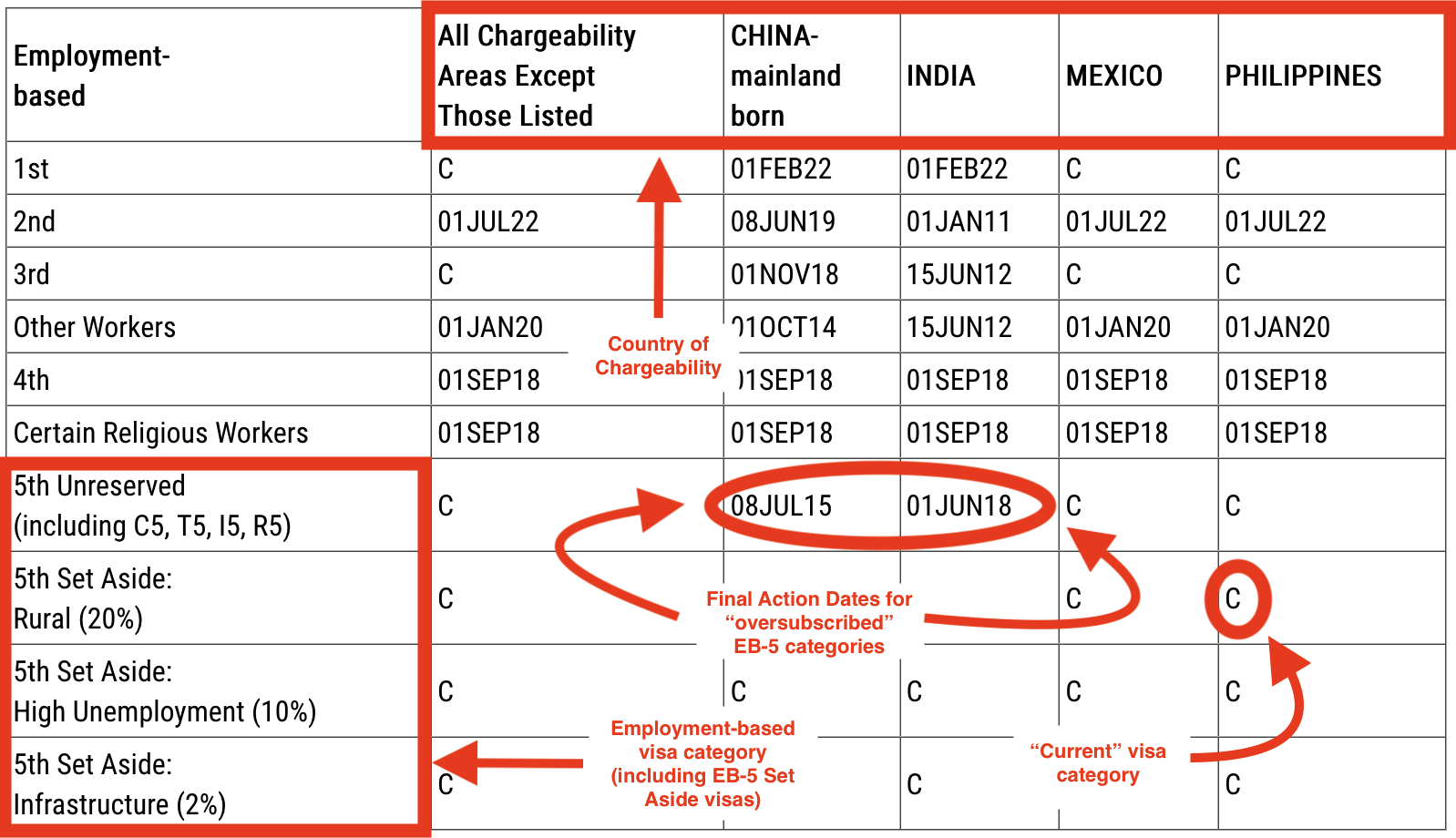

An employment-based fifth preference category (EB-5) financial investment visa gives an approach of coming to be an irreversible united state resident for foreign nationals intending to spend capital in the United States. In order to get this permit, an international financier has to invest $1.8 million (or $900,000 in a Regional Facility within a "Targeted Employment Location") and create or maintain at the very least 10 full-time jobs for USA employees (excluding the financier and their immediate family).

This procedure has actually been a significant success. Today, 95% of all EB-5 funding is raised and spent by Regional Centers. Because the 2008 economic crisis, accessibility to funding has actually been constricted and local budgets remain to encounter considerable shortfalls. In several regions, EB-5 investments have loaded the financing space, supplying a new, crucial resource of funding for neighborhood financial growth projects that renew communities, develop and support tasks, framework, and solutions.

Eb5 Investment Immigration - The Facts

workers. Additionally, the Congressional Budget Workplace (CBO) scored the program as income neutral, with administrative expenses spent check my blog for by candidate costs. EB5 Investment Immigration. Greater than 25 countries, including Australia and the UK, usage similar programs to draw in foreign financial investments. The American program is a lot more strict than numerous others, calling for considerable danger for investors in regards to both their financial investment and immigration standing.

Family members and people that look for to relocate to the United States on a long-term basis can use for the EB-5 Immigrant Capitalist Program. The United States Citizenship and Migration Provider (U.S.C.I.S.) established out various needs to obtain permanent residency through the EB-5 visa program.: The very first step is to discover a certifying investment opportunity.

Once the chance has actually been determined, the capitalist has to make the financial investment and send an I-526 application to the U.S. Citizenship and Migration Provider (USCIS). This application has to consist of proof of the financial investment, such as financial institution declarations, acquisition contracts, and business plans. The USCIS browse this site will assess the I-526 application and either accept it or demand extra proof.

See This Report on Eb5 Investment Immigration

The capitalist needs to request conditional residency by submitting an I-485 request. This petition has to be submitted within 6 months of the I-526 authorization and have to include evidence that the financial investment was made which it has developed at least 10 full click now time jobs for united state employees. The USCIS will certainly examine the I-485 petition and either authorize it or request extra proof.

Comments on “Eb5 Investment Immigration - An Overview”